Improving financial health @ING

UX Design Research Financial Health ING

UX Design Research Financial Health ING Improving Financial Health of Young Adults

I undertook a project at ING, which culminated from 18 weeks of research and design work. The focus of my project was the financial health of young adults aged 18-35. Motivated by the increasing number of people around me struggling with their finances and experiencing high levels of stress, I observed the same trend in news and articles. Recognizing the importance of financial well-being for young adults, I decided to delve into this subject.

Promo video

Background and Motivation

Specializing in UX and research design, I have always been intrigued by the psychology of human behavior and decision-making. My minor in Behavioral Design provided valuable knowledge that I wanted to apply to the field of finance. Therefore, in this project, I was determined to focus on the human aspects of finance and explore how we can raise awareness and provide insight to young adults regarding the consequences of their financial choices.

Design Challenge

“How can I assist financially vulnerable young adults in improving their financial situation and raise awareness about the consequences of unwise financial choices?”

Research Process

To address my design challenge, I followed an iterative design process. I conducted extensive research, carefully formulated and explored questions to gain a better understanding of the target audience. Personally engaging with approximately 64 random respondents throughout my project, I obtained profound insights into the experiences, beliefs, behaviors, and motivations of the target group.

Solution

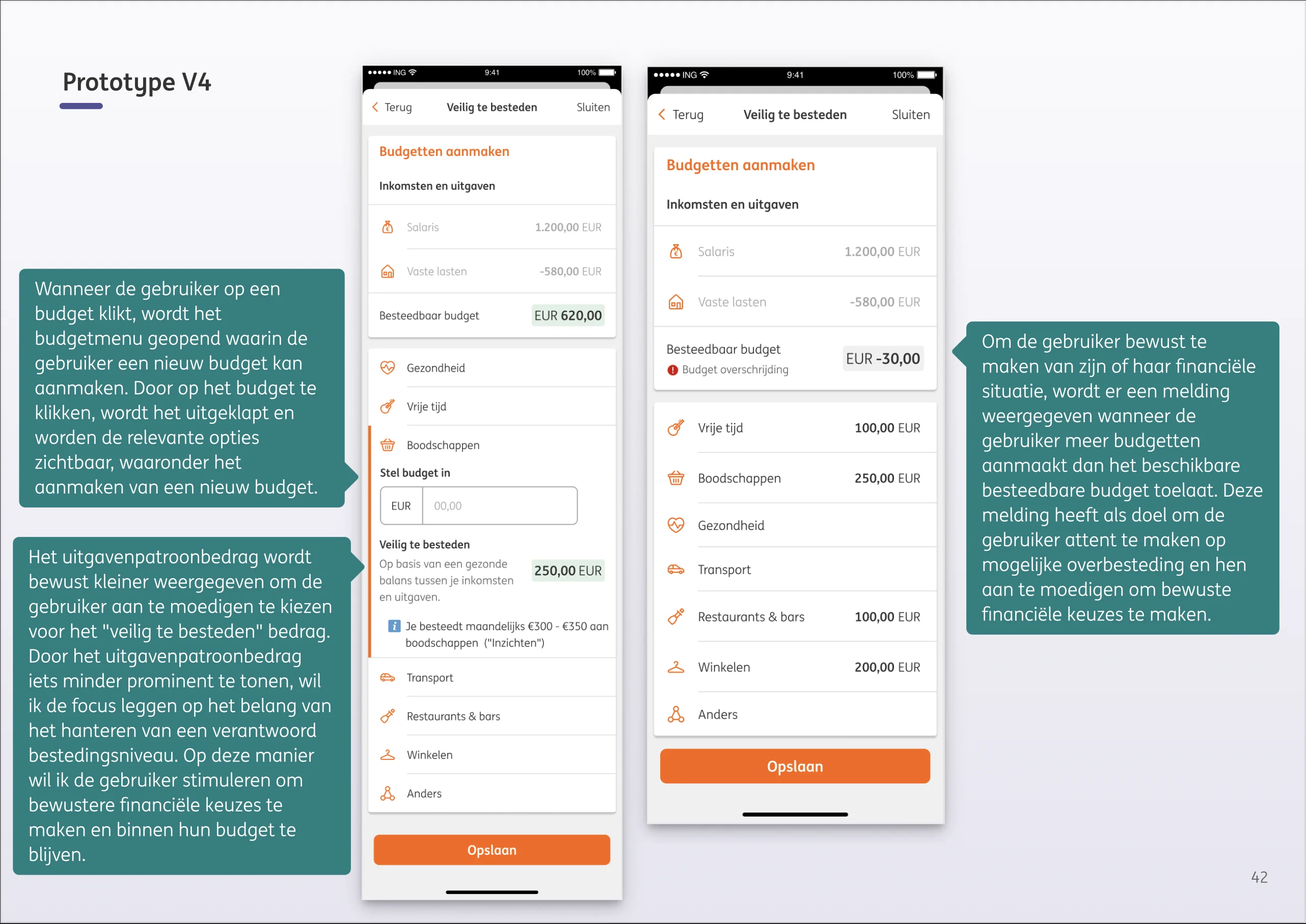

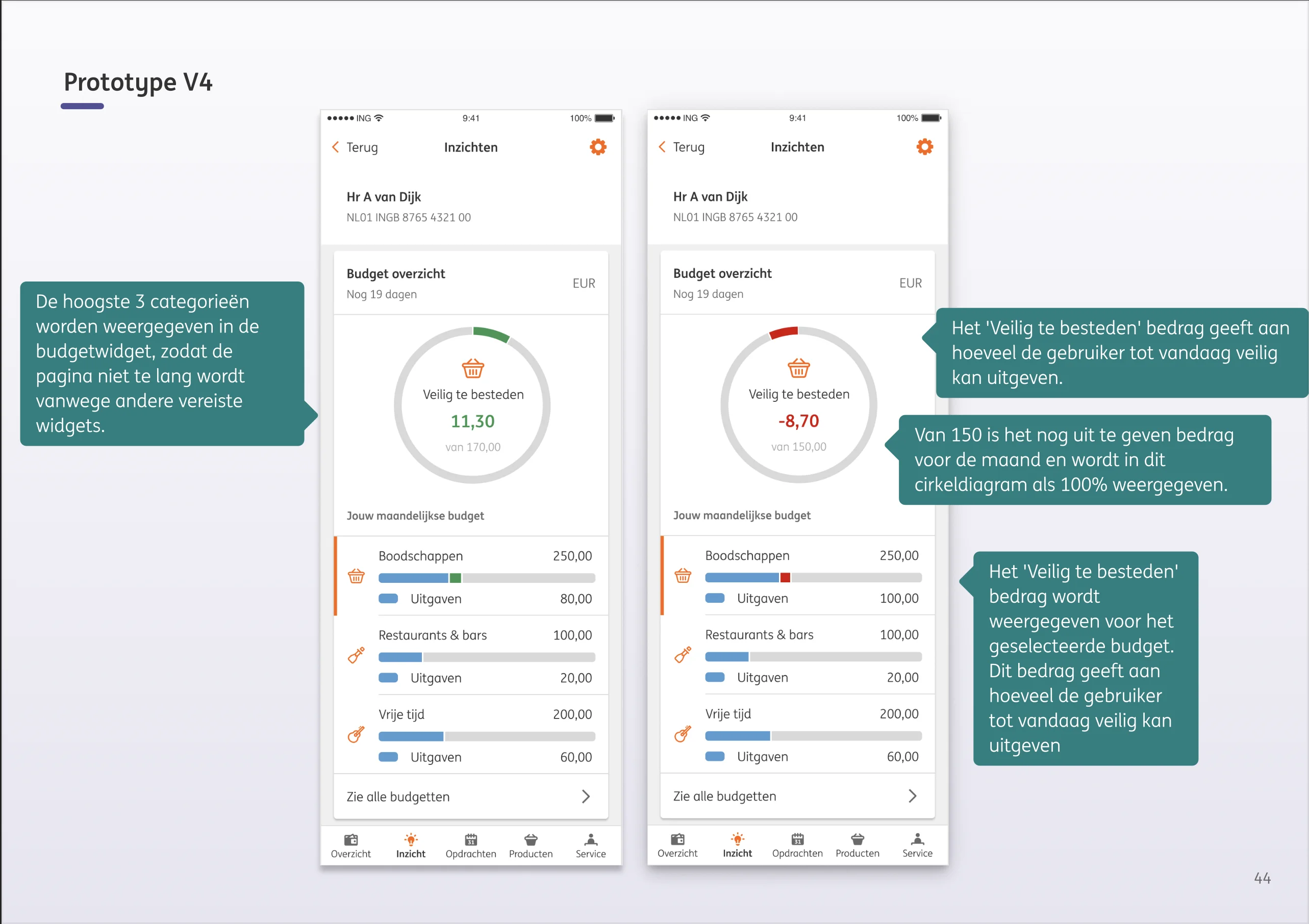

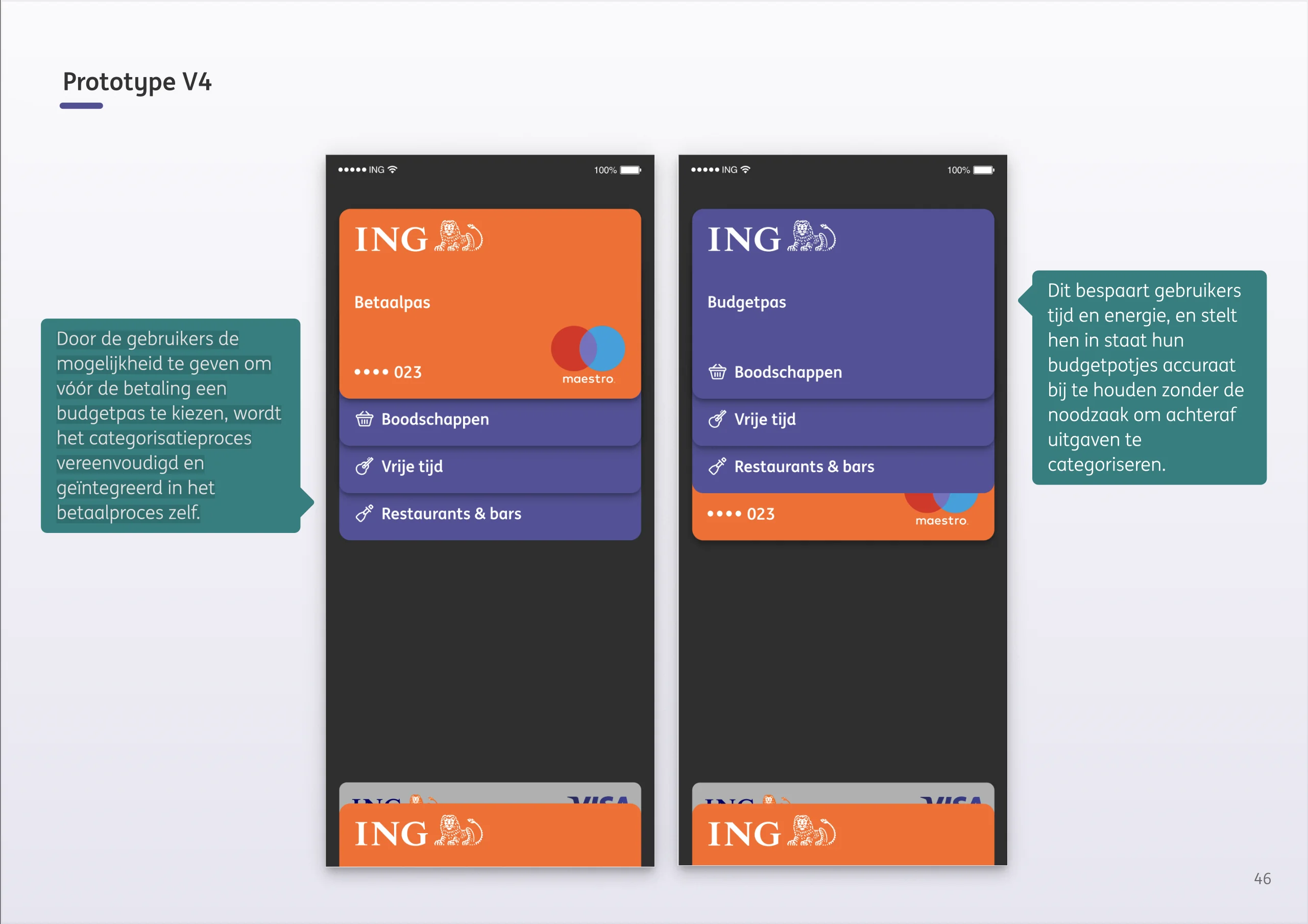

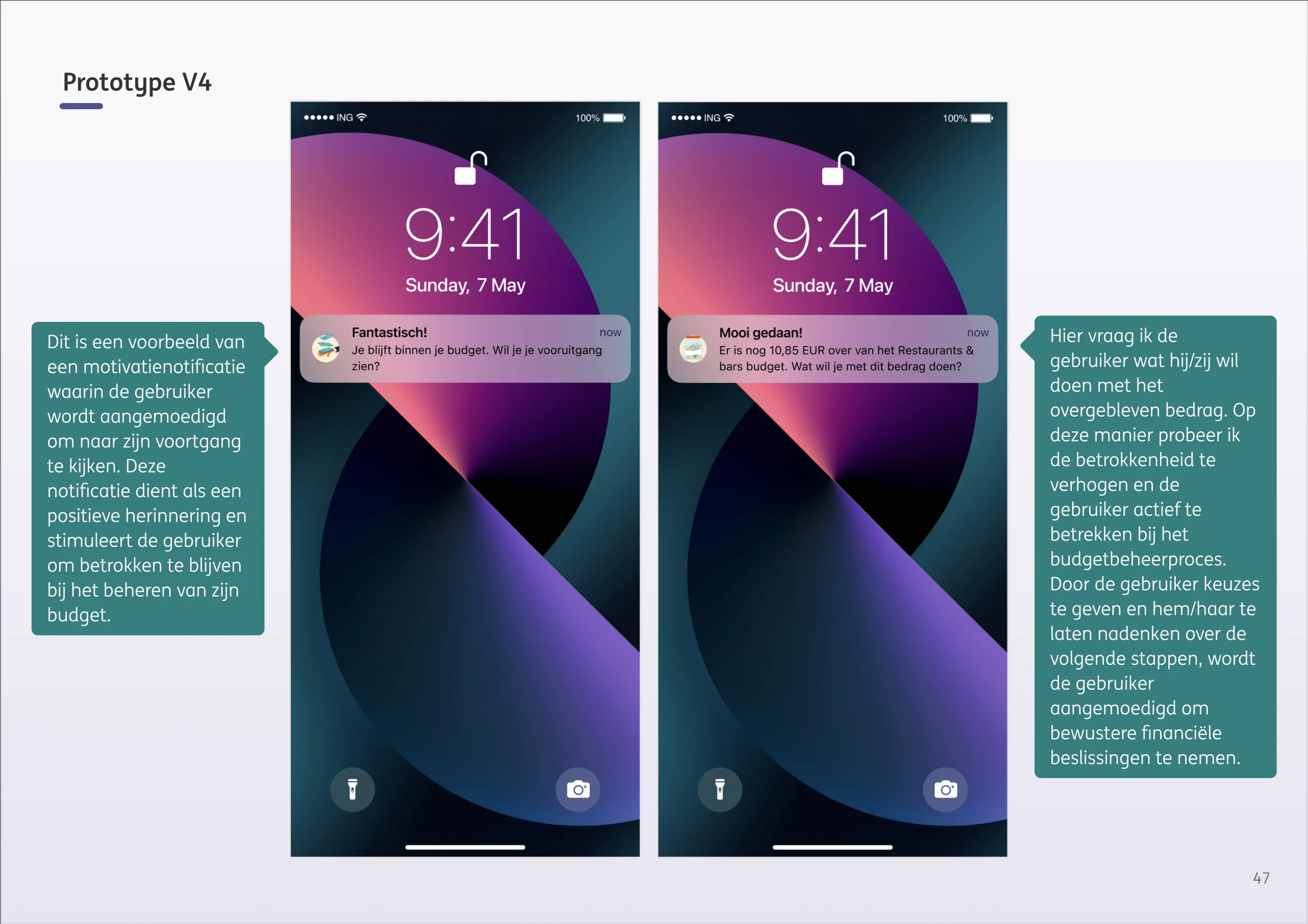

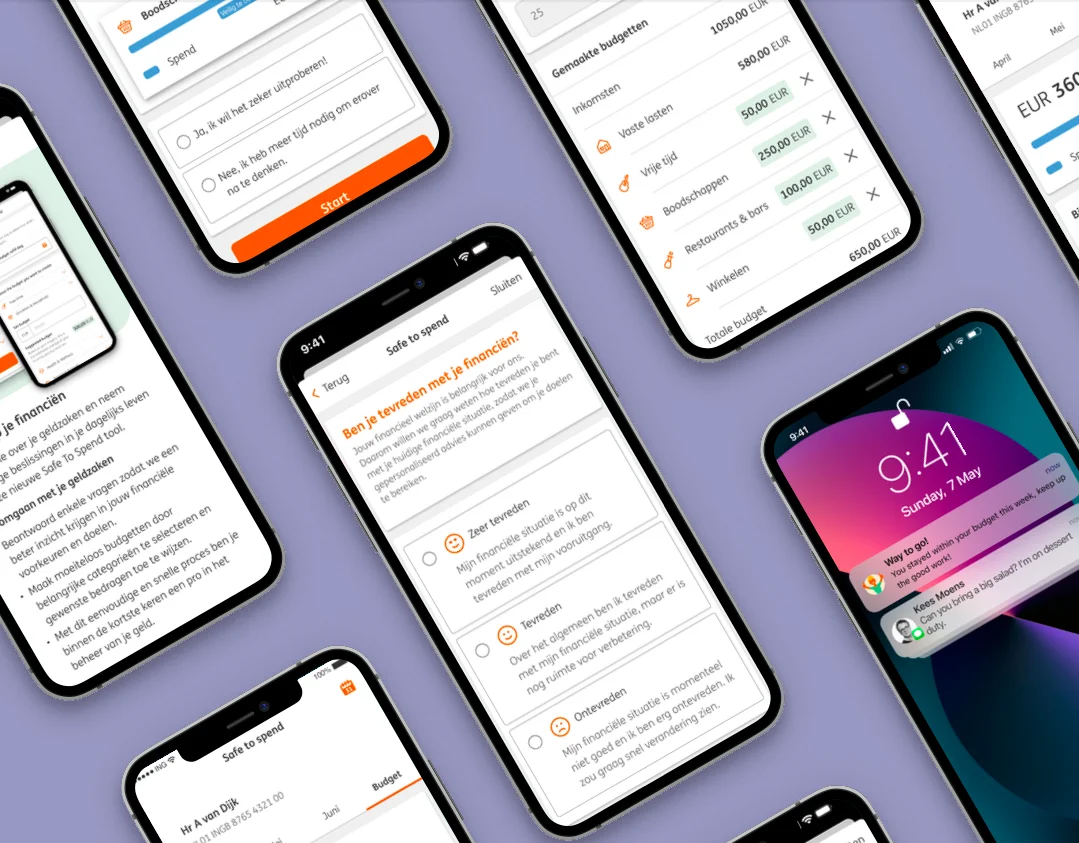

To address the needs of financially vulnerable young adults, I have designed a new feature within the ING app called “Safe To Spend.” This feature provides personal insights and notifications that highlight the consequences of financial choices. During the onboarding process, users evaluate their financial situation and set goals, enabling ING to offer relevant support. Budgets can be set and managed using the “Safe To Spend” suggestion, which indicates a safe spending amount. The “Insights” section of the app provides clear information on budgets and daily spending limits, empowering users to make informed financial decisions. To simplify budget allocation, I introduced budget cards that seamlessly integrate categorization into the payment process, eliminating post-categorization hassle. And with the motivational notifications I want to encourage users to make conscious choices and stay engaged with their finances.

Reflection

Looking back on the 18 weeks dedicated to my this project, I take pride in the achieved results. My design challenge revolved around assisting financially vulnerable young adults in improving their financial situation and raising awareness about the consequences of unwise financial choices. Although challenging, I am delighted to say that I succeeded.